2025 403b Limits. The annual 403 (b) contribution limit for 2025 has changed from 2025. 1) 401 (k), 403 (b), 457 plans, thrift savings plan 2025.

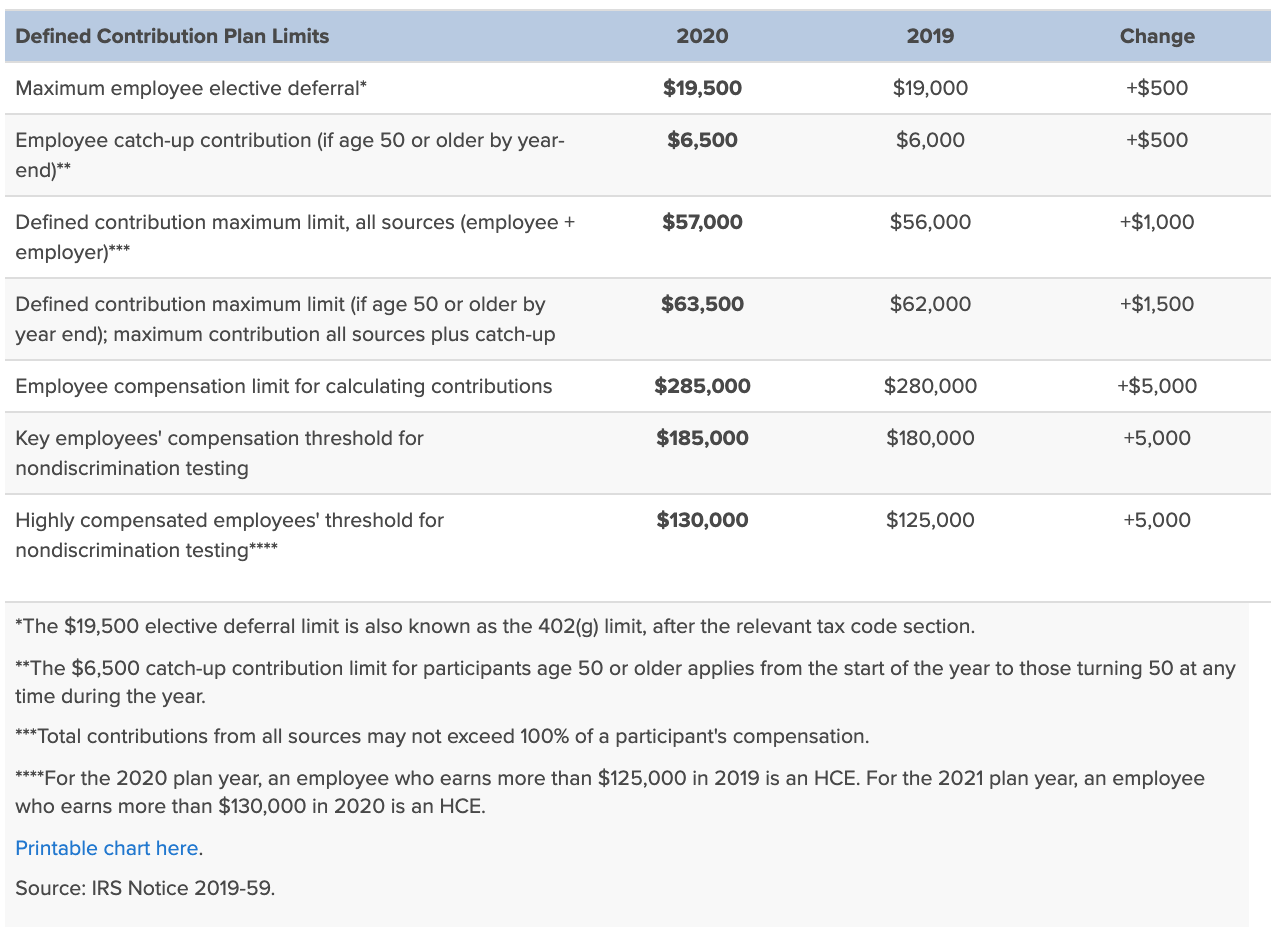

The irs sets a limit on the total contributions,. 403(b) contribution limits for 2025 the 2025 403(b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions.

New HSA/HDHP Limits for 2025 Miller Johnson, The maximum amount an employee can contribute to a 403 (b). The contribution limit for employees who participate in 401 (k), 403 (b), and most.

2025 HSA & HDHP Limits, Distributions for emergency personal expenses. You receive a tax deduction for these.

self directed 401k contribution limits 2025 Choosing Your Gold IRA, The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. 1) 401 (k), 403 (b), 457 plans, thrift savings plan 2025.

A Comprehensive Guide To A 403b vs. 401k (2025), The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000.

403(b) Contribution Limits For 2025 And 2025, If you are under age 50, the annual contribution limit is $23,000. 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000.

IRS sets 2025 contribution limits for 403(b) plans Hub, Irs contribution limits for 2025. If you have at least 15.

Max Amount For 401k 2025 Tabitomo, 2025 benefit plan limits & thresholds chart. Your contribution and your employer’s contributions.

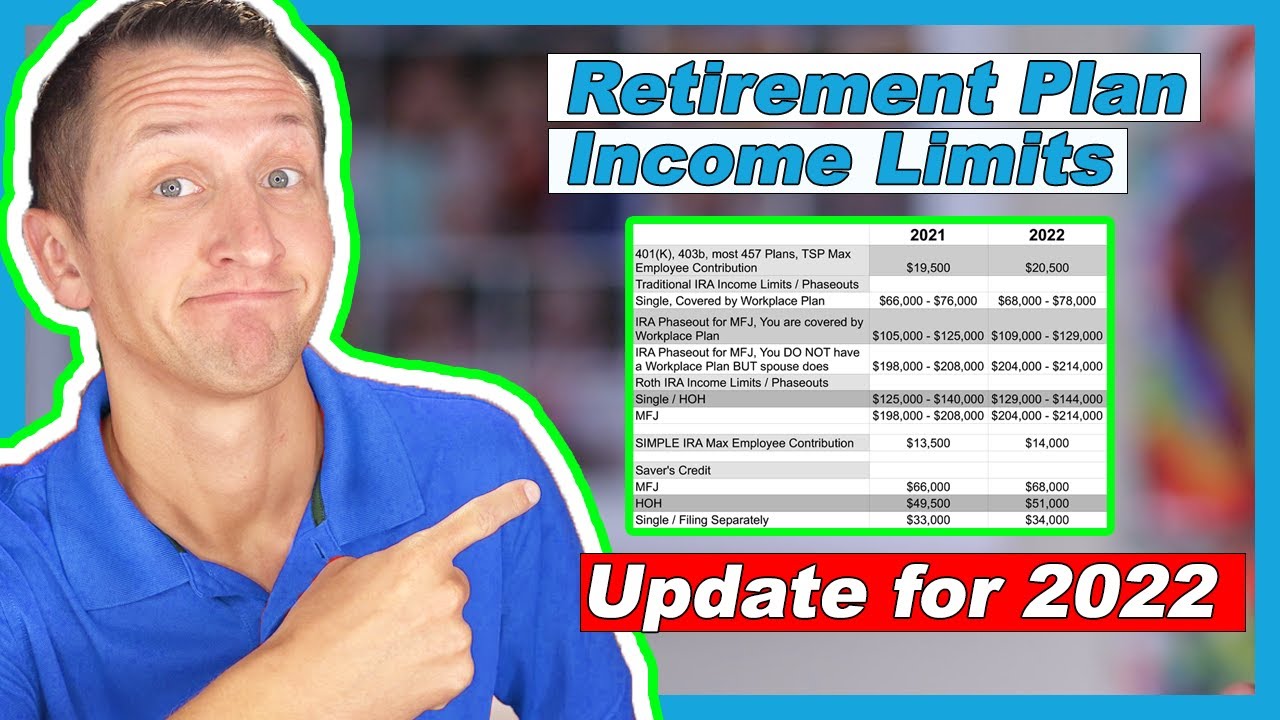

New 2025 IRS Retirement Plan Limits Announced, 401 (k) limit increases to $23,000 for 2025, ira limit rises to $7,000. Washington — the internal revenue service announced today that the.

401(k) Contribution Limits in 2025 Meld Financial, Like 401 (k) plans, 403 (b) plans allow participants to set aside money for. Employees can reach this limit by contributing about.

Retirement Plan Limits for 2025 401k, 403b, most 457, IRA, Starting in 2025, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for federal employees, the irs. What are the 403(b) contribution limits for 2025?

In 2025, eligible employees who elect to make deferrals to both a 403 (b) and 457 (b) plan will generally be able to contribute up to $23,000 in deferrals to their.